There has been a lot of discussion recently about a "balanced" approach to our debt problem. You know, some cuts...but some tax increases, too. I am not a follower of the "balanced" approach. You see, I believe the "balanced" approach is one reason why we are in this mess. If I live beyond my means, spending more money than I take in, I might suggest taking out a loan to pay for my rent. I would tell my wife, "but honey, I know we need to make some adjustments to our spending, but we need a 'balanced' approach--one that involves loans." While I may use the word balanced, I have not addressed the true problem.

The government takes in plenty of cash. Don't be fooled. It's not the amount of money coming in, it's the amount of money going out that is the problem. Our entitlement programs have created a demand for government programs, and the government is more than happy to supply. With other people's money, of course.

It's called redistribution of wealth. Take from some, give to others. Government doesn't create wealth, businesses (the people running the businesses) create wealth. The goal of business is to make money, and that "making money" is what drives employment. Employment comes from the expansion of business. An expanding government is not creating more jobs, it's creating more cost. That cost requires the government to take in more money, and that money comes from productivity. If everyone had a government job, there would be no productivity to tax to generate revenue to pay the government employee. Hence, everyone would have a job, but nothing to spend the money on. And with no businesses making money, there would be no tax revenue coming in to the government coffers. No money in the government coffers, no ability to pay government employees. This is the fallacy of the people who believe more government jobs is good, and subsequently, more government spending is good. That money that the government is spending is not their own.

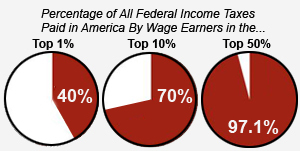

The President gave a speech on Friday (it's hard to keep up with all his speeches), in which he said that rich people can give up more of their income because...well, they can. While this is technically true, where is the fairness in this? He advocated that it's "only fair" to ask for the rich to help even more, even though 50% of the country doesn't even pay taxes. Our tax system is progressive, which means that not only do people who make more money pay more in taxes, they are actually taxed at a higher rate. To say that people who are already progressively taxed should solve a problem created by the consumption (through social security, medicare, medicaid) of a majority of people who don't even pay taxes is ludicrous, not just unfair.

My MBA program began with an introductory course in economics. It was a very good course, and I really enjoyed the book we used. It was written by a professor at Harvard, who had served on President Bush's Council of Economic Advisers.

"Suppose that some editor offered me $1,000 to write an article. If there were no taxes of any kind, this $1,000 of income would translate into $1,000 in extra saving. If I invested it in the stock of a company that earned 8% a year on its capital, then 30 years from now, when I pass on, my children would inherit about $10,000. That is simply the miracle of compounding."

"Now let's put taxes into the calculus. First, assuming the Bush tax cuts expire, I would pay 39.6% in federal income taxes on that extra income (and a phaseout of deductions adds 1.2%)...I also pay Medicare tax...and I pay 5.3% in state income taxes. Putting all those taxes together, that $1,000 of pretax income becomes only $523 of saving."

"And that saving no longer earns 8%. First, the corporation in which I have invested pays a 35% corporate tax on its earnings. So I get only 5.2% in dividends and capital gains. Then, on that income, I pay taxes at the federal and state level. As a result, I earn about 4% after taxes, and the $523 in saving grows to $1,700 after 30 years."

"Then when my children inherit the money, the estate tax will kick in. The marginal estate tax is scheduled to go as high as 55% next year, but Congress may reduce it a bit. Most likely, when the $1,700 enters my estate, my kids will get, at most, $1,000 of it."

"Here's the bottom line: Without any taxes, accepting that editor's assignment would have yielded my children an extra $10,000. With taxes, it yields only $1,000. In effect, once the entire tax system is taken into account, my family's marginal tax rate is about 90%. Is it any wonder that I turned down most of the money-making opportunities I'm offered?"

No, Professor, it doesn't. When we punish success, that seems the logical conclusion.

Which society do you want to live in? One that punishes those who supply the revenue to operate? If you do that long enough, people leave or stop working. As Congressman Boehner said today, "I've always believed, the bigger the government, the smaller the people. And right now, we have a government so big and so expensive it's sapping the drive of our people and keeping our economy from running at full capacity...the solution to this crisis is not complicated: if you're spending more money than you're taking in, you need to spend less of it."

Sometimes the simple things are just too simple for Washington, I guess.

I can not understand why this is so hard for Washington to get. I feel congress & the president insult my intelligence by trying to convince me that (A) I somehow am not contributing enough of my salary even though after taxes now, I have very little to save for my future just trying to keep current living expenses covered. And (B) Their continuous expenditure of my tax money to "pork style" projects is a greater benefit to me than if I kept my hard earned money & invested it myself.

ReplyDelete